Cannabis Commerce [1] founder and journalist Lory Kohn, at KushCon II [2]

In a nation crying for new industry, with budget shortfalls impacting every level of government, cannabis commerce is a shining star hovering on the economic horizon. Cannatax generated from cannabis commerce could provide a lifeline for embattled governments desperate to maintain vital services in the face of rising costs.

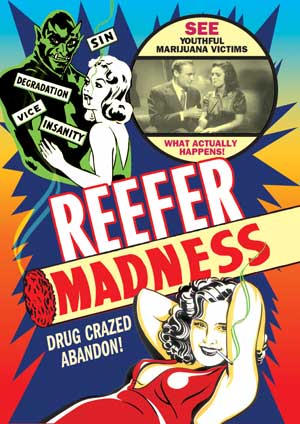

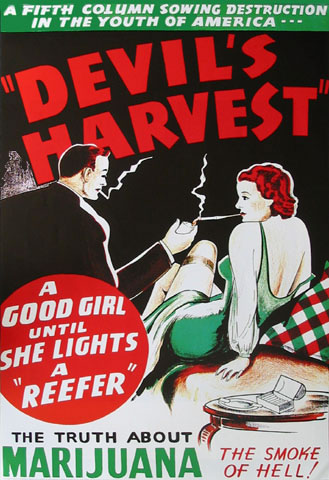

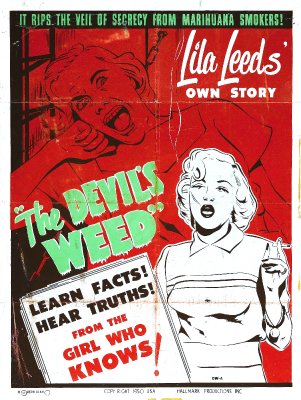

It isn’t, because demonization derived from the 1930s is responsible for marijuana “activists” settling for medical marijuana initiatives state-by-state instead of working together to overturn federal prohibition altogether – which effects legalization for every state in one fell swoop. This is a bizarre situation, where a group of like-minded citizens who overwhelmingly outnumber the opposition behaves like a minority which has to beg, plead, and cajole for “patients’ rights” instead of everybody’s rights.

Why should you care about cannatax? Perhaps after driving the family van to Yellowstone, you and your brood might actually want to find the park open? Maybe you’re having difficulty remembering if your local library’s reduced schedule is Monday/Thursday/Friday or Tuesday/Wednesday/Saturday? Maybe you harbor hope your kid could learn in a classroom with less than fifty students? Then again, you may experience personal growth from being on hold for an hour or more waiting to talk to a live person about extending your unemployment benefits, since only 5 percent of the people who want to work in the cannabis industry can presently do so. If that's the case, stop reading here!

The ability to collect bounty from cannatax revenue is also a core justification for legalization. As we’ll see, there’s legitimate concern whether accepted cannatax predictions have come in way too low to accurately reflect what a fully-firing cannabis industry could contribute to every level of government. When accurate figures emerge – like those you’re about to read – curiosity about cannatax will increase exponentially.

Cannatax is available from city, county and state sales taxes, individual and business state and federal income taxes, licensing fees, import and export fees, and “sin taxes” – special levies placed on substances like alcohol and tobacco. According to The New York Times’ Stephanie Saul, most states are dependent on sin taxes generated by alcohol and tobacco sales to survive. And they’re barely scraping by. What if cannatax was added to the mix? That would be quite helpful in altering the current climate of doom and gloom holding the country in its sway.

If I told you that the United States can generate an easy $67 billion worth of cannatax in a fully legal, regulated economy – just for openers – would that get your attention? A cessation of pursuing, prosecuting, and incarcerating marijuana “criminals” would free another $50 billion, bumping the gain to $117 billion.

Over the next year, the State of Cannarado is looking at an actual, not theoretical, $160 million windfall from medical marijuana-related sales tax alone – without accounting for licensing fees or personal and business state income taxes.

Promising, right?

That’s why cannatax figures are finding their way into every form of media. Coverage generally takes the form of one-line quotes from economists, like “Harvard PhD Dr. Jeffrey Miron said today marijuana sales could generate $6.2 billion in tax revenue annually.” Until now, no one knew how he calculated that figure. Therefore, no one had the audacity to question whether it seemed high or low. Presumably, only ivory tower cognoscenti, with years of secondary education, could possibly do that.

However, as we spelunk into federal and state cannatax calculations, you’ll be surprised to discover that these figures are considerably less mystifying than the high priests of poteconomics would have us believe. In fact, most of them involve nothing more challenging than middle school math.

Is it possible that Cannabis Commerce Chief Inspirational Officer Lory Kohn, who played in a rock band called "The Milkmen," actually knows more about cannatax than the leading PhD economists on Earth?

Cannatax in The USA

Forecasting cannatax tests economists used to analyzing legal substances people have no emotional involvement with, like soybeans. When an illegal or quasi-legal substance beloved by millions enters the equation, suddenly economists have competition. Quite a few lovers of herbal gold are practiced in "observation of empirical data," having grown, nurtured, trimmed, transported, bought and sold bushels – if not tons – of it in the real world. That real-world experience levels the playing field with poteconomists, who often have difficulty distinguishing a rolling paper from a Post-It note. That's because avoiding anything gooey, gunky, stony, and skunky is paramount to preserving their tenure at institutes of higher learning.

To determine maximum potential cannatax, poteconomists choose from three accepted methodologies:

- They can extrapolate from demand-side data, like Harvard’s Dr. Jeffrey Miron, the most-quoted man in marijuana – and the most criticized for producing low forecasts. Demand-side data measures consumption, or how much people “smoke.” This data comes from DEA surveys of marijuana “offenders.” These questionnaires are flawed, because they ask persons facing 20 years in prison to document their “crimes.” Putting faith in DEA surveys requires accepting that the agency which lost the war on drugs has won the war on statistics. That’s a leap of logic not every poteconomist is willing to make. Forecasting based on demand-side data, particularly DEA-generated demand-side data, always results in low figures.

- They can extrapolate from supply-side data. This requires knowing how many metric tons of marijuana were purportedly seized and/or eradicated by the DEA. The DEA models these statistics, saying, “OK, we intercepted 5,000 pounds of marijuana coming into the country, and we believe that constitutes 10% of the total amount coming into the country. Therefore 50,000 pounds came into the country.” That’s not exactly bulletproof science. Wunderkind Max Chaiken, a Brown undergraduate whose sensational $212 billion projection was picked up by The New York Times’ Freakonomics blog, mines supply-side data exclusively. It produced his astonishingly high numbers.

- They can extrapolate from both demand-side data and supply-side data, or better yet attempt to reconcile the two of them, like Dr. Jon Gettman, former head of NORML, who earns my vote for the most rational poteconomist. Gettman turned over the most stones and performed the heaviest lifting to identify and analyze telling data not supplied by the DEA. He even turned to statistics furnished by High Times magazine, to name one perfectly legitimate source ignored by more conventional prognosticators. In capable hands like Gettman’s, mining both demand-side data and supply-side data results in the most believable prediction.

Note the use of the verb “extrapolate” as opposed to “count.” That’s because no one has managed to attach a bar code to Lime Kush – yet. In other words, all poteconomists are forced to guesstimate.

Camera-shy Dr. Jon Gettman is a cannatax calculating monster.

“We have very limited data about how many people consume marijuana,” Gettman relates. “The problem is, we don’t have an inventory, an audit, a census . . . of all the marijuana that’s coming into the country or grown here. It’s not like it’s registered in a warehouse and it’s brought to market.”

Miron concurs: “The crucial problem in figuring out how much tax revenue we’d get is we don’t know the size of the market. It’s hard to determine the precise size of any economic market, especially if it’s underground. It’s subject to a lot more doubt.”

When they’re doubtful, poteconomists become anxious. Then they make mistakes – like failing to account for revenue streams they should have accounted for (coming right up).

The following forecasts for cannatax in the USA have received some degree of notoriety:

- Dr. Jeffrey Miron: $6.5 billion average over five white papers penned from 2002-2010.

- Dr. Rosalie Pacula and Dr. Jonathan Caulkins, for the RAND Corporation, which is largely financed by the government: figures too close to Miron’s to distinguish.

- Dr. Jon Gettman: $40 billion in “lost taxes” for the year 2010

- CNBC: $42 billion, stated on its Marijuana and Money show.

- Max Chaiken, Brown undergraduate: [in his own words]: “a legally taxed and regulated marijuana market could generate upwards of $200 billion annually in excise tax [a.k.a. “sin tax”] revenues for the federal government … [which] would be enough to fund Medicaid.” Under heavy interrogation from Cannabis Commerce, Chaiken backed off his high estimate, but held firm convincingly on his “bare minimum” prediction of $71 billion.

- Cannabis Commerce: $67 billion: used Gettman’s $40 billion as a baseline, then bumped it to $50 billion, giving Chaiken credit for presenting convincing evidence that more metric tons were coming into the country. Cannabis Commerce then identified obvious corporate revenue streams totaling $17 billion other poteconomists neglected to address.

Getting back to those mistakes and lapses in logic, please note:

- Miron, Pacula, and Caulkins fail to account for licensing fees. “I agree, these should be in there,” Miron admitted when pressed. They give credence only to DEA or ONDCP (Office of National Drug Control Policy) generated statistics using demand-side data exclusively. They don’t turn over every rock they could to find additional revenue streams.

- Miron admits he worries what the DEA thinks about his reports: "I wanted to use a number that is basically beyond criticism, OK, in particular, beyond criticism from the White House drug czar office and the DEA." It's also a number which fails to illicit any excitement whatsoever, and for that, it can considered a disservice to people trying to make informed decisions about legalization. If that's all there is, South Dakota's share could barely finance a community dog run.

- Gettman didn’t address sin taxes at all in his 2007 classic Lost Taxes and Other Costs of Marijuana Prohibition (he addressed these in a 2010 interview with Cannabis Commerce).

- Chaiken’s prediction is a figure based on calculating sin taxes at the rate of 50% alone. Curiously, he didn’t project income taxes, sales taxes, or licensing fees – an epic oversight.

- None of the poteconomists considered any of the following revenue streams: licensing fees, import and export taxes, and industrial use, to name just a few.

Regarding the additional revenue streams unearthed by Cannabis Commerce, these didn’t take a flash of great genius to discover – they were obvious. For example, if marijuana were suddenly fully legal and regulated, does anyone doubt the pharmaceutical industry would jump in with any number of therapeutic products?

Jeff Miron, the media's go-to guy for pot tax quotes.

Gettman doesn’t: “There’s a lot of money to be made by developing highly refined pharmaceuticals based on the chemical ingredients in marijuana. Yeah, there’s billions of dollars there.”

Now that you’ve got a taste what goes into calculating cannatax, let’s examine Gettman’s Lost Taxes methodology and demystify how cannatax is calculated:

- Gettman averaged four different scenarios and concluded that there were about 15,000 metric tons (a metric ton is 2,204 pounds) of marijuana sold in the USA in 2006. 15,000 multiplied by 2,204 = 333,060,000 pounds.

- He assigned an average price per pound to these of around $3,500. 33,060,000 multiplied by $3,500 = around $113 billion in annual sales. Hold that thought.

- Economists accept that the amount of “government receipts” (i.e. state and federal income taxes; local, county, and state sales taxes; FICA, Medicaid) individuals and businesses wind up paying on any given product averages out to 28.70-percent.

- Gettman chose to calculate government receipts by “source as percentage of GDP (Gross Domestic Product).” The “source” is the $113 billion in marijuana sales.

- If we divide the source of $113 billion by the 28.70 percentage of GDP, the total of lost taxes comes in right around $31 billion.

- In 2010, prodded by Cannabis Commerce, Gettman started accounting for sin taxes at around 25%, bringing his total to $40 billion.

Think there’s more than 15,000 metric tons sold annually? Many people do, including the National Drug Threat Assessment of 2010, which, according to Max Chaiken, “puts the number of how much is produced in Mexico at 21,500 metric tons. Even if only half of that is coming into the United States, that’s 10,750 metric tons right there. And we know that a lot of it’s being grown in this country as well. So it’s not inconceivable to me that we have 20,000, maybe 25,000 metric tons on the domestic market that’s being consumed by Americans.”

If you agree, just multiply however many metric tons you think are consumed by $3,500 a pound, or whatever figure you feel, based on your own experience in the trade or other knowledge you may have, is a more accurate real-world gauge of what a pound sells for.

Fun With Cannarado Sales Tax

Now that MMCs (medical marijuana carecenters, a.k.a dispensaries, collectives, co-ops, clubs) in Cannafornia and Cannarado have rung up a few years’ worth of retail sales, useful statistics have emerged. That means we can guess a whole lot less. We can mine actual MMC pricing data — and make more meaningful inferences about the readiness of The World's Most Promising Commodity to assume its rightful place as a consistent producer of government revenue a la alcohol and tobacco.

If you live in another state, like Grohio, the amount of cannatax that can be collected in a fully legal, regulated landscape is dependent upon your population. Bear in mind that cannatax figures will always be crippled in medical marijuana states, because only the chronically ill or people pretending to be chronically ill will be transacting. That sad state of affairs limits cannatax to 5% of what it could be if anyone could buy cannabis like anyone can buy alcohol and tobacco.

Play the game

Here's how to find an easy $160 million in annual “Cannarado” sales tax, providing you know where to look:

- Around 1,500 Cannarado dispensaries applied for state operating licenses before the filing deadline of July 1, 2010.

- Let's “err on the side of caution” and hypothesize that each of the 1,500 retail dispensaries sell half a pound a day. That’s not a whole heckuva lot. In other words, collectively the state's dispensaries sell 750 pounds daily.

- There are 448 grams in a pound. Therefore, 750 pounds times 448 grams = 336,000 grams, a reasonable guesstimate of the amount of grams sold daily in Cannarado dispensaries derived from actually interviewing owners.

- Let's assign a ridiculously low average price of $10 per gram. Multiplying 336,000 grams by $10 = $3,360,000. In other words, around $3,360,000 worth of marijuana is sold in Cannarado dispensaries daily.

- The state sales tax on medical marijuana is 3.25%. So, 3.25% of $3,360,000 = $109,200 in state sales tax collected daily by the State Department of Revenue.

- $109,200 a day state sales tax multiplied by 365 days in a year = $39,858,000 a year for the state. Call it $40 million.

What if every municipality allowed dispensaries?

Now, stop and consider the fact that dispensaries are banned from many Cannarado municipalities (every city and county presently has the right to allow them or ban them). Also, the number of dispensaries is presently frozen until July 1, 2011, pending further review. Let's be "plaid pants" conservative and claim there's room for 25% more dispensaries, that is, if they were allowed to operate freely all over the state.

That would boost the state sales tax revenue up 25% ($10 million), from $40 million to a number which rounds off to $50 million.

What about city sales tax?

It's a fact that each municipality collects roughly the same city sales tax percentage, 3.25%, that the state charges. Chalk up another $50 million.

So, the combined city and state sales tax figures amount to around $100 million in "Cannarado" from sales of raw buds alone.

What about those MIPs (marijuana infused products)?

However, we haven't accounted for the increasing amount of edibles (brownies, sodas, fruit bars, cereals, lollipops, ice cream, you name it) sold yet. Let's guesstimate edible sales presently constitute 10% of dispensary sales (and rising). Bump $100 million 10% ($10 million) to $110 million. Cannabis cosmetics are also a burgeoning field, but these products are too new to account for.

And cultivation supplies?

Then there's the matter of sales taxes for cultivation supplies necessary to grow marijuana. We're talking about grow lights, soil, nutrients, hydroponic and aeroponic supplies, climate control systems, containers, etc. I don't know that there's any hard data yet about what this industry grosses statewide, but I'll make an educated guess from actually talking to growers [as opposed to regurgitating DEA data] that production costs – not including labor or electricity – to produce the 750 pounds sold daily in the state's MMCs come to at least 10% of the selling price of the buds.

10% of $110 million is $11 million. That bumps our ultra-cautious guesstimate to $121,000,000 million.

Underground to Overground?

We’ve only talked about legal, above board, medical marijuana sales. Lots of people who'd love to transact at dispensaries have personal and professional reasons not to obtain medical marijuana cards. If no one was worried about losing their job, do a third more cardholders sound believable? The actual percentage would probably be greater than that. Given the choice, who wouldn't want to pick from twenty strains instead of one?

Take a third of $121,000,000 — around $40 million — tack it on, and land in the $160 million range.

Now we're getting somewhere.

Your turn to play

Now it’s time to account for variables. In reality, most dispensaries sell more than a half-pound a day. However, not all those dispensaries will get the licenses that they applied for. But more will be allowed to apply come next summer. How many dispensaries do you think there will be once the dust settles? Plug that number into your estimates.

In April 2011, premium grams still sell for closer to $15 than $10. Therefore, without accounting for edibles or cultivation supplies, there could be as much as $150 million possible in annual city and state sales tax based on sales of pure buds alone (we previously calculated $100 million @ $10/gram; $15 a gram is 50 percent higher, so $100 million becomes $150 million).

Just plug in any variable and guesstimate – remember, every poteconomist admits they do the exact same thing.

That’s a bunch of figures to process for now. Keep in mind that we just calculated Cannarado sales tax only; we didn’t discuss licensing fees (like the $90 application fee you and 150,000 other residents totaling some $13 million may have already paid the Department of Revenue), personal and business state income taxes, and the inevitable sin taxes coming down the pike.

Any way you look at it, it would take quite a nimble mind to argue against collecting cannatax on the 25,000 or so metric tons of marijuana consumed annually in the USA. It’s going to be purchased anyway. So why not tax it?

I can answer that in a word reprised from earlier in this article: demonization. An eerily-enduring subject deserving of its own article . . .

| Attachment | Size |

|---|---|

| reefermadness_jpg.jpg [5] | 32.55 KB |

| thedevilsweed.jpg [6] | 47.38 KB |

| devilsharvest.jpg [7] | 56.59 KB |

| KohnatKushCon2500.JPG [8] | 54.69 KB |