SearchUser loginOffice of CitizenRest in Peace,

Who's new

|

Cuyahoga County Property Tax Lien SALE - May 31, 2013 * WARNING PAY YOUR PROPERTY TAXES OR FACE THE PREDATORY TAX COLLECTORS *Submitted by Gone Fishin on Tue, 05/07/2013 - 19:57.

Mary Irene Burns - Delinquent Property Tax Lien Queen!

The tax lien queen is living the dream at 5355 Elmridge Circle, Excelsior, MN, in a million dollar home- right on the lake.

The queen of vulture capitalism - who forecloses on poor people - lives in a million dollar mansion.

Cuyahoga County is gearing up to sell out the people of Cuyahoga County to PREDATORY TAX COLLECTORS who will continue supporting Mary Irene Burns- the Delinquent Property Tax Lien Queen!

**** WARNING ****

If you owe more than one year of delinquent property taxes, you stand a great risk of being sold out to predatory tax collectors that will buy your lien, charge 18% interest and expensive attorney fees.

The Cuyahoga County tax lien sale is scheduled for MAY 31, 2013. http://c.ymcdn.com/sites/www.thentla.com/resource/resmgr/2013_tax_sale_info/advertisement2013sale(negoti.pdf

Despite extensive research that proves time and time again that selling property tax liens greatly contributes to the foreclosure crisis and throws property owners to the vultures, Cuyahoga County will hold their sale on MAY 31st.

It is very risky business for counties to deal with these thieves. There have been several criminal convictions and settlements relative to the tax lien folks in several states- including in Ohio. http://realneo.us/content/jp-morgan-chase-aka-plymouth-park-admits-tax-lien-rigging-ohio-211-million-settlement-cuyaho

Several people have contacted me lately with complaints regarding Woods Cove II Tax Liens. Woods Cove purchased the last tax liens in Cuyahoga and several other counties , and they have wasted no time in filing foreclosures after the one year redemption period. Pay your 18% interest charge or Woods Cove will file a tax lien foreclosure case in a blink of an eye, and you will then be responsible for the attorney fees - usually around $2500.

I believe that Woods Cove II - an anonymous group of investors that uses a mail drop off facility - will again purchase tax liens from Cuyahoga County at the next sale in a few weeks.

I am working with an attorney on several issues with tax liens in Cuyahoga County and he is attempting to help county property owners with some legal issues that he has discovered. An important case that he appealed for sanctions against the attorneys for the tax lien predators was won on appeal and the case is remanded to Cuyahoga County Court of Common Pleas. More details will be shared after the trial.

Some of the information shared here is from the anonymous attorney and I appreciate his efforts in sharing information with me. He is working very hard on this issue.

Below is some information relative to Woods Cove Tax Liens:

Woods Cove I has a new officer in Wayzata, Minnesota (suburb of Minneapolis). He is James Kenneth Beltz. Formerly a partner in Wayzata Investment Partners = Lakeview Holding. I am attaching a deed they recorded this week in Franklin County from Woods Cove I to some buyer of the house forfeited. Beltz lists himself as the Managing Director of Woods Cove and is the Minneapolis point-man for Imperial Capital Asset Management (Imperial Capital LLC) of Los Angeles, CA.

Woods Cove II got the Summit County tax liens in 2011 and Cuyahoga County ones in 2012. But Woods Cove I bought its tax liens in Franklin County in 2010 for 13.25%. Cuyahoga they get the for 18%. That means that the folks in Cuyahoga County have to pay their tax bill plus 18% to redeem; in Franklin County, it is 13.25%. So these investors seem to make a good enough return at 13.25% at auction.

Woods Cove III won the Summit County bid in December, 2012 and Woods Cove I, II, III, and IV are all operating in this State. There is a tax sale in Cuyahoga County in May, 2013 so I wonder who will be the winning bidder? My bets are on Woods Cove III or IV.

Found some lovely customer service from Woods Cove II in Summit. Lots of complaints.

Still trying to figure out whose money Imperial Capital is investing or managing. It lists itself as an investment bank.

************************************************************************************************************

An appellate decision was recently released - Lakeview Holding v. Deberry, 4-11-2013 - which will have a costly effect on tax lien companies if they fail to timely file their foreclosures after filing an intent to foreclose.

Lakeview Holding appealed a decision on the 120 day period when they filed their notice of intent to foreclose. Their foreclosure case was dismissed because they failed to timely file their foreclosure case within the 120 day time frame.

Below is a summary of the court's decision:

Court holds there is no final appealable order if the Foreclosure Magistrate and trial judge dismiss the tax certificate foreclosure because the notice of intent to sue is filed after 120 days.

The court sidesteps the argument whether the 120 day period is a condition precedent or whether it is an affirmative defense. But the court notes the statute since 2008 mandates that a foreclosure be filed within 120 days under R.C. 5721.37(A)(2). This sounds more like it is a condition precedent - meaning, a judge can raise the issue because it appears on the face of the certificate and complaint.

The effect of this is, that Aeon, Capitalsource, Lakeview, and Woods Cove II would have to get a new notice of intent to refile. And since 2008, they must also pay the property taxes still owing on the property (not just the tax certificates). So it costs them more money to refile because they have to bring the property taxes current before they foreclose.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

When a tax lien company purchases a tax lien, they must wait the one year redemption period to see if the property owner pays the lien. After the one year period, the tax lien company files a 'notice of intent to foreclose' on the property. They are given a 120 day period in which to file their foreclosure. If they fail to file their foreclosure within this time frame and proceed to file after the 120 day period, their foreclosure case is defective. The case should be dismissed and they will have to file another 'intent to foreclose' and refile a new foreclosure case. The tax lien company will also have to pay any additional property taxes that have accrued on the property. The tax lien company will also have to pay additional filing fees and court cost.

There is a very good magistrate hearing these tax lien foreclosure cases who should be applauded for following the law and not allowing these tax lien companies to scam people, while the other magistrates appear to be just going with the flow and allowing defective and fraudulent cases to proceed to foreclosure.

The magistrate is Carol Weiss.

Lakeview Holding is alleged to have engaged in frivolous conduct and their alleged misconduct will be discussed in an upcoming appeal. This appeal is an important case and could affect over 80 properties that have been foreclosed upon- possibly illegally. It is possible to have the judgment reversed for the 80+ properties.

Magistrate Carol Weiss has discovered their misconduct and dismissed several cases filed by Lakeview Holding. She is doing a great job.

Lakeview Holding filed a 'motion to disqualify' Magistrate Weiss as they did not like that she follows the law. In their motion, Lakeview Holding stated that Magistrate Weiss is biased and dismissing their cases, while the other magistrates simply push the cases thru and grant the foreclosures. Lakeview Holding attempted to have Magistrate Weiss disqualifed and removed from hearing any of their cases. The motion was denied.

Lakeview Holding is filing fraudulent judicial reports.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

It is unfortunate that Cuyahoga County continues to sell out it's people. Years and years of overlooking tax delinquent property owners that are connected to politicians and targeting those that are least able to defend themselves. http://realneo.us/content/cuyahoga-county-land-bank-president-gus-frangos-worlds-biggest-idiot-land-bank-scam-fraud-wa

The victim leaving his home owned for nearly fifty years- for the last time. http://realneo.us/content/plymouth-park-tax-services-aka-xspand-cuyahoga-county-victims-corruption-deserve-justice

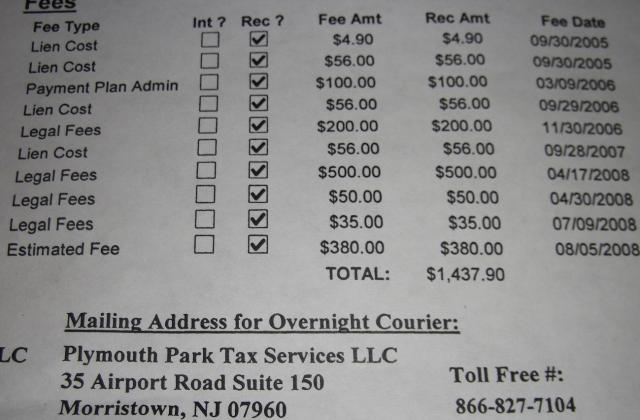

The predators charge excessive fees and folks that are already financially struggling do not stand a chance with these thieves:

After the tax lien companies foreclose on property owners and transfer the deeds, THEY DO NOT PAY THEIR OWN PROPERTY TAXES.

The Tax Lien Thieves are well aware that the heat is on them and their predatory collections, bid rigging, anti-trust violations, etc... :

After busts, tax-lien industry asks for antitrust training

By David Ingram 3/8/13

WASHINGTON (Reuters) - Solo investors, specialty investment firms and others who buy up property tax liens for a profit are studying the finer points of U.S. antitrust law after watching comrades in their niche face charges of bid rigging.

A Department of Justice lawyer familiar with a series of recent cases in New Jersey has signed on to speak at a training session next month for the National Tax Lien Association.

The training is part of a plan to inform members about antitrust pitfalls in the auctions where liens are bought and sold. It will be at the association's annual meeting in Miami.

Tax liens have grown as a popular investment in recent years, offering everyone from retirees to hedge funds a chance to earn high interest rates.

Tax liens as an investment are controversial for starters because they often mean higher costs for homeowners who fall behind on their tax bills and are in danger of foreclosure.

After placing liens on unpaid tax bills, many municipalities and county governments auction the liens off as a quick way to replenish their coffers. In exchange, the investors hope to collect what the taxpayers owe, plus interest and a penalty.

The sales are common in 29 states and annually add up to $6 billion on average, according to the National Tax Lien Association, a trade group based in Jupiter, Florida. The total has been higher since the U.S. housing crisis began.

Fear of criminal prosecution rippled through the industry in the past few years as the Department of Justice's Antitrust Division brought cases of alleged bid rigging in the local auctions where the lien sales take place.

Bid-rigging convictions can mean prison time and millions of dollars in fines under the Sherman Act.

"No one would ever violate the Sherman Antitrust Act if they knew the significance of the penalties," said Brad Westover, executive director of the National Tax Lien Association.

The association began regular training sessions at its annual meeting last year, Westover said. At his request, the Antitrust Division has agreed to send a trial attorney from New York this year.

Congressional fights over the federal budget, however, have been complicating travel plans across the federal government.

The Antitrust Division, while declining to comment, has made clear it wants to do more than just prosecute cases. The division has held training on other subjects in the past, including the prevention of procurement fraud in the 2009 federal stimulus package.

Brian Dickerson, a Washington lawyer who helps the trade group in training, said people still associate antitrust violations with large corporations.

When speaking to tax-lien buyers, he said he needs to explain, "It could be two guys standing at an auction in Duluth, Minnesota, bargaining it out, saying 'I'll take this, you take that.'"

BIDDING ON INTEREST

The tax-lien auctions vary from state to state, from faceless online exchanges to the classic "open outcry" affair.

In some states, investors bid by saying the interest rate they propose to collect from the delinquent taxpayer. In New Jersey, the rate can be as high as 18 percent but is lower in an auction that is competitive. The maximum rate is higher still in some other states.

Bidders in some auctions across New Jersey rigged the system ahead of time by agreeing what the winning interest rate would be, prosecutors said in a series of cases they have brought there, mostly since 2011.

Eight individuals and three companies have pleaded guilty, according to the Department of Justice.

One of the companies, Crusader Servicing Corp of Jenkintown, Pennsylvania, was ordered in December to pay a $2 million fine.

Department of Justice officials consider the investigations part of their response to the U.S. housing crisis because the victims are often foreclosed homeowners forced to pay higher interest rates on their liens.

National Consumer Law Center attorney John Rao, a critic of tax-lien sales generally as slanted against homeowners, said antitrust violations compound his objections.

"If there's no competition, a homeowner could be stuck with an 18 or 20 percent interest rate," he said.

Westover said he tells his members to assume there is a federal agent at every tax-lien auction in the country.

"We don't want to venture anywhere near something that could look on the wrong side of the law," he said.

Cuyahoga County ignores competion and property owners here are charged 18% interest despite lower interest rates in neighboring counties.

There is help available. ***** DO NOT IGNORE YOUR TAX DELINQUENCY. *****

Restoring Stability

Unable to pay your property taxes?

If you are a homeowner with a financial hardship and are having trouble paying your property taxes, you may be able to get help through Restoring Stability: A Save the Dream Ohio Initiative administered by the Ohio Housing Finance Agency (OHFA).

Am I Eligible?

You may be eligible for Restoring Stability if you can answer “yes” to the following questions:

Homeowners who meet one or more of the eligibility requirements listed above are encouraged to register for the Restoring Stability program.

What is the next step? Register online for Restoring Stability at: www.savethedream.ohio.gov or Call Restoring Stability toll-free at 888-404-4674 *** My blogs expressing my freedom of speech rights - especially on matters of public concern - are my opinion and not the opinion of my friends, family or employer ***

( categories: )

|

Recent commentsPopular contentToday's:

All time:Last viewed:

|

Woods Cove Tax Liens

In November 2011, Woods Cove II purchased 2,329 delinquent property tax liens in Cuyahoga County.

Immediately after the one year redemption period ended, Woods Cove II proceeded to file foreclosures.

In late 2012, just after the one year redemption period ended, Woods Cove II filed 209 foreclosures.

In 2013, Woods Cove II filed 849 foreclosures. It is only May 2013, and foreclosures are still being filed by Woods Cove II.

A total of 1058 of the 2329 liens sold by Cuyahoga County have resulted in foreclosure filings, and more foreclosures will be filed.

A total of 1059 property tax liens have been released - paid by the property owner. Each property owner paid 18% interest and possible legal fees if foreclosures were filed.

A very high percentage of the tax liens sold by Cuyahoga County end up in foreclosure. Those that are able to save their homes are now responsible for the 18% interest and attorney fees since legal work was involved in the filing of the foreclosures.

Many property owners will not be able to afford the excessive interest and fees. This will add fuel to the foreclosure crisis.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Cuyahoga County is on the prowl - another delinquent tax sale

Cuyahoga County has now planned a second delinquent property tax lien sale which is scheduled for September 26, 2013.

Folks, PAY your property taxes or make payment arrangements with the county.

Apply for help here http://www.savethedream.ohio.gov/

** DO NOT BECOME MORE THAN ONE YEAR TAX DELINQUENT WITH PROPERTY TAXES - unless you are connected to county officials. **

http://realneo.us/content/slavic-village-community-development-selling-property-those-owe-delinquent-property-taxes-cu

The county land bank is eating up our tax dollars. The county is hungry for $$$$$ and will sell you out in a blink of an eye.

The county's con artist is having a ball with our tax dollars. http://realneo.us/content/gus-frangos-president-cuyahoga-county-land-bank-con-artist-jesus

The Cuyahoga County Land Bank DOES IT AGAIN!! 41 MILLION DOLLARS http://cuyahogalandbank.org/pressReleases/NSP2_expenditure_release_5-3-13v5.pdf

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

09/26/2013-Cuyahoga County Property Tax Lien Sale

How come these dates are not listed on the county website's calendar????????????????

Ehhem???? Just more confusion and misinformation to the public at large. same old unethical practices. surreal.

12/30/12-Notice published for open bids.

05/31/13-Bidder packet submission deadline

09/26/13-Tax Lien Sale

CUYAHOGA COUNTY, Ohio. December 20, 2012 - Cuyahoga County Fiscal Officer Wade Steen announces Cuyahoga County's Annual Tax Lien Sale. The sale will be held Thursday, September 26, 2013. Interested parties have until 9:00 a.m. on May 31 to submit bids. Bidding requirement documents must be submitted to the county no later than than May 30, 2013.

BIDDING DOCUMENTS and INFORMATION

Cuyahoga County 2013 Tax Sale Advertisement

Bidder Registration Form

Financial Standing Document

2012 Executed Purchase Agreement

Please note that there may be changes to the 2013 Purchase Agreement. Please refer to Ohio Revised Code Section 5721.30 – 5721.43 for details regarding the sale process and conduct of bidders.

Bidders interested in obtaining a pre-sale file and additional bidder information should contact Kristy Neff at kneff [at] cuyahogacounty [dot] us or call 216-443-2145 or Mark Campbell at Mcampbell [at] cuyahogacounty [dot] us or call 216-443-8181.

http://cuyahogacounty.us/en-us/calendar.aspx...................says one thing..............

Shows another..................http://www.thentla.com/news/112067/Cuyahoga-County-Announces-2013-Tax-Lien-Sale.htm:

Always Appreciative, "ANGELnWard14"