SearchUser loginTAX LIEN SALES TO PRIVATE COLLECTION BUSINESSESOffice of CitizenRest in Peace,

Who's new

|

Cuyahoga County Property Taxes - some owners are forced to pay and others get a FREE RIDE - 3025 West 25th StreetSubmitted by Gone Fishin on Sat, 06/22/2013 - 22:28.

3025 West 25th Street, Cleveland, Ohio

FREE RIDE on property taxes for YEARS. Property taxes owed $ 40,378.65 I wonder who this property owner knows. No property taxes paid for years:

I wonder how Freddie, Tim, Darren, and the Ali family would feel after learning that they lost their family homes - each owned for nearly 50 years and three of the houses were owned MORTGAGE FREE- for petty delinquent property taxes while this property owner gets a free ride - FOR YEARS.

Over FORTY THOUSAND DOLLARS in delinquent property taxes.

Cuyahoga County officials selectively pick and choose which folks to sell out for delinquent property tax liens:

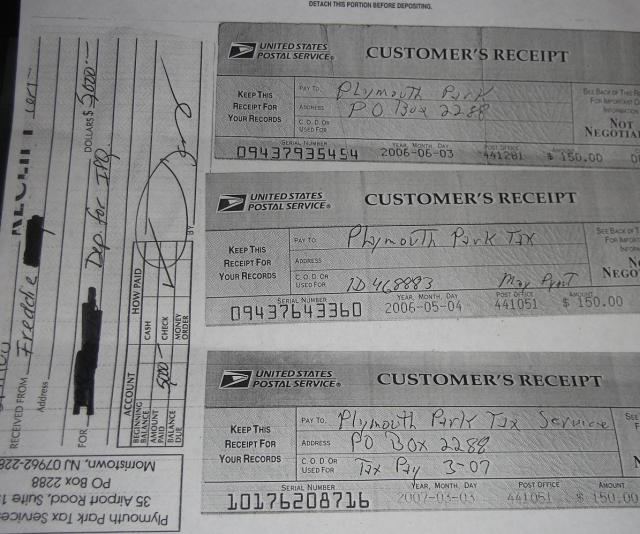

Freddie - family home owned for over 50 years- lost for less than $2000 delinquent property taxes AFTER the tax lien company took a large sum of money and still stole his home.

Despite not paying property taxes for years on the property located at 3025 West 25th Street, Cleveland, Ohio, and the $40,000 dollar tab, NO liens were ever sold to tax lien thieves. This property was simply overlooked for many years.

This property has gone too far with delinquent property taxes, so county officials would not be able to sell a property tax lien. It would not be profitable to the tax lien thieves.

County officials have to file a tax foreclosure case on their own for the numerous cases exactly like this in which property taxes were simply overlooked for years - such as the " Dirty Dozen":

Cuyahoga County’s Top Tax Delinquencies (“The Dirty Dozen.”)

Cuyahoga County’s first “Dirty Dozen” list is below. This list was compiled by scanning the county’s delinquency files for large taxpayers and by combining multiple delinquencies of parcels owned by the same individual or business. Some property owners who owe large amounts are not included on this list because they are seeking a property tax exemption (and thus may end up not having any tax liability) or for other reasons.

- See more at: http://executive.cuyahogacounty.us/en-US/110111-delinquent-taxpayers.aspx#sthash.zpNE0yHY.dpuf How did the " Dirty Dozen" get so damn dirty?

What the hell was the former County Treasurer - Jim Rokakis - doing while in office???? ( other than ignoring the chosen few and targeting the little people )

Cuyahoga County Land Bank - Creators dabble in TEN MILLION DOLLAR Property Jim Rokakis & Gus Frangos

Rokakis boasts about the 'state-of- the-art billing and collection processes' :

In 1997, Jim took office as Cuyahoga County Treasurer, bringing his innovative skills and passion for the community to a struggling county office. In the decade that followed, Jim overhauled the entire office and greatly enhanced the county's existing tax collection system by instituting state-of-the-art billing and collection processes.

I wouldn't refer to this billing and collection process as state-of-the-art anything.

The alleged 'state-of-the art billing and collection process' failed to detect Jim Rokakis own employee's - Gus Frangos - tax delinquency on numerous properties hidden behind shell LLCs. Details HERE http://realneo.us/content/gus-frangos-president-cuyahoga-county-land-bank-con-artist-jesus

The state-of-the-art equipment also failed to detect Gus Frangos' brother's ( Lou Frangos ) tax delinquency, which led to Frangos' being placed on the "Dirty Dozen" list of property owners that owed Cuyahoga County the most money in delinquent property taxes. Details HERE http://www.cleveland.com/naymik/index.ssf/2011/11/its_about_time_cuyahoga_county.html

The new county fiscal officer is cleaning up Rokakis' mess.

The county has to file delinquent property tax foreclosures itself on numerous properties that owe too much in delinquent property taxes and are not worthy of the private tax lien investor's interest, such as Rokakis' former employee's shell LLC properties:

PRESIDENT of the Cuyahoga County Land Bank - County Con Artist GUS FRANGOS - adds MORE fuel to the Foreclosure Crisis

County officials were too busy nickle and diming the little people - the easy targets - and often overlooked the connected property owner's delinquent property taxes.

Those hardest hit by the selective process of targeting the little people and selling them out to tax lien thieves were minority property owners on the east side of Cleveland and eastern suburbs, and it was certainly NOT because other non-minority property owners on the west side or western suburbs were paying their property taxes.

In my opinion, the selective sell out has resulted in a Civil Rights violation of the Federal Fair Housing Act - which the ' state-of-art tax collection and bll processing' should have caught.

Below is a list of all the property owned (stolen) by Plymouth Park Tax Services at the time of my research a few years back, along with the delinquent property taxes that Plymouth Park Tax Services owed to the county themselves at the time of my research.

After foreclosing on property owners for delinquent property taxes, these tax lien thieves DID NOT pay their own property taxes. This was also overlooked by Rokakis and not picked up by the 'state-of-art collection and bill processing system'.

Notice the addresses of all the properties. The victims of the tax lien foreclosures are disproportionately African Americans:

PROPERTY OWNED BY PLYMOUTH PARK TAX SERVICES:

1. 1613 Elberon Ave, East Cleveland, OH 44112 delinquent taxes $2,053.47

2. 4150 E 138 St, Cleveland, OH 44105 delinquent taxes $1,592.59

3. 13909 Orinoco Ave, East Cleveland, OH 44112 delinquent taxes $1,568.73

4. 890 E 130 St, Cleveland, OH 44108 delinquent taxes $2,917.99

5. 13215 Alvin Ave, Garfield Hts, OH 44105 delinquent taxes $2,331.27

6. 1516 Luxor Rd, East Cleveland, OH 44112 delinquent taxes $1,297.17

7. 12414 Farringdon AVE, Cleveland, OH 44105 delinquent taxes $2,411.11

8. 1061 E 167 ST, Cleveland, OH 44110 delinquent taxes $2,090.81

9. 3234 W 88 St, Cleveland, OH 44102 delinquent taxes $1,608.16

10. 1622 E 84 St, Cleveland, OH 44103 delinquent taxes $2,667.86

11. 11806 Fairport Cleveland, OH 44108 delinquent taxes $1,451.10

12. 14113 Tokay AVE, Maple Hts, OH 44137 delinquent taxes $2,773.79

13. 11902 Fairport Cleveland, OH 44108 delinquent taxes $1,446.14

14. 14113 Tokay AVE, Maple Hts, OH 44137 delinquent taxes $ 2,773.79

15. 11902 Fairport Cleveland, OH 44108 delinquent taxes $1,446.14

16. 3529 East BLVD, Cleveland, OH 44105 delinquent taxes $3,253.54

17. 12904 Dove AVE, Cleveland, OH 44105 delinquent taxes $6,479.00

18. 13619 Christine AVE, Garfield Hts, OH 44105 delinquent taxes $5,581.56

19. 9607 Parmelee Ave, Cleveland, OH 44108 delinquent taxes $1,216.22

20. 10805 Earle Ave, Cleveland, OH 44108 delinquent taxes $2,451.29

21 805 E 131 ST , Cleveland, OH 44108 delinquent taxes $1,612.16

22. 3877 E 142 St, Cleveland, OH 44128 delinquent taxes $3,827.72

23. 3780 Mayfield RD, Cleveland Hts, OH 44121 delinquent taxes $10,164.97

24. 4046 Northfield Rd, Highland Hills Village, OH 44122 delinquent taxes $3,678.81

25. 24275 Donover Rd, Warrensville Hts, OH 44128 delinquent taxes $3,217.43

26. 15127 Granger RD, Maple Hts, OH 44137 delinquent taxes $6,291.79

27. 19919 Mountville Dr, Maple Hts, OH 44137 delinquent taxes $3,003.55

28. 3625 Washington BLVD, Cleveland Hts, OH 44118 delinquent taxes $5,174.37

29. 942 Pembrook Rd, Cleveland Hts, OH 44121 delinquent taxes $12,557.41

30. 1282 E 186 St, Cleveland, OH 44110 delinquent taxes $1,844.77

31. 4002 Trent AVE, Cleveland, OH 44109 delinquent taxes $2,015.08

32. 10321 Parkgate AVE, Cleveland, OH 44108 delinquent taxes $2,855.04

33. 11316 Durant AVE, Cleveland, OH 44108 delinquent taxes $7,981.65

34. 27701 Mills AVE, Euclid, OH 44132 delinquent taxes $2,232.32

35. 12325 Park Knoll Dr, Garfield Hts, OH 44125 delinquent taxes $1,818.64

36 13408 S Parkway DR, Garfield Hts, OH 44105 delinquent taxes $2,394.20

37. 4673 E 85 St, Garfield Hts, OH 44125 delinquent taxes $3,476.40

38. 13421 Emerson Ave, Lakewood, OH 44107 delinquent taxes $4,547.51

39 4072 E 139 ST, Cleveland, OH 44105 delinquent taxes $873.58

40 4344 E 141 ST, Cleveland, OH 44128 delinquent taxes $5,186.68

41. 4115 E 146 ST, Cleveland, OH 44128 delinquent taxes $1,362.21

42. 16205 Judson Dr, Cleveland, OH 44128 delinquent taxes $953.36

43. 19807 Longbrook RD, Warrensville Hts, OH 44123 delinquent taxes $2,376.01

44. 16105 Mendota AVE, Maple Hts, OH 44137 delinquent taxes $11,011.57

45. 16305 Friend Ave, Maple Hts, OH 44137 delinquent taxes $3,019.45

46. 19819 Kings HWY, Warrensville Hts, OH 44122 delinquent taxes $8,283.79

47. 3608 Palmerston RD, Shaker Hts, OH 44122 delinquent taxes $28,184.22

48. 5110 Philip St, Maple Hts, OH 44137 delinquent taxes $2,671.00

49. 19107 Gladstone Rd, Warrensville Hts, OH 44122 delinquent taxes $2,523.68

50. 3651 Latimore Rd, Shaker Hts, OH 44122 delinquent taxes $8,767.02

51. 1983 Warrensville Center RD, South Euclid, OH delinquent taxes $13,136.66

52. 2236 Edgerton Rd, University Hts, OH 44118 delinquent taxes $5,888.70

53 3388 Cedarbrook Rd, Cleveland Hts, OH 44118 delinquent taxes $3,845.20

54. 1164 Melbourne RD, East Cleveland, OH 44112 delinquent taxes $4,690.15

55. 907 Caledonia AVE, Cleveland Hts, OH 44112 delinquent taxes $7,444.12

56. 1680 Beverly Hills DR, Euclid, OH 44117 delinquent taxes $3,367.92

57. 25570 Tungsten RD, Euclid, OH 44132 delinquent taxes $3,231.96

58. 3967 E 121 St, Cleveland, OH 44105 delinquent taxes $3,357.74

59. 12528 Forest AVE, Cleveland, OH 44120 delinquent taxes $5,887.51

60. 3920 E 99 St, Cleveland, OH 44105 delinquent taxes $1,318.11

61. 9601 Heath AVE, Cleveland, OH 44104 delinquent taxes $1,203.47

62. 7812 Force AVE, Cleveland, OH 44105 delinquent taxes $1,930.77

63. 3279 E 130 ST, Cleveland, OH 44120 delinquent taxes $2,536.84

64. 1237 E 114 ST, Cleveland, OH 44108 delinquent taxes $2,351.40

65. 1827 Haldane RD, Cleveland, OH 44112 delinquent taxes $4,986.37

66. 16910 Grovewood Ave, Cleveland, OH 44110 delinquent taxes $2,043.33

67. 13417 Rugby RD, Cleveland, OH 44110 delinquent taxes $2,365.97

68. 15720 Mandalay Ave, Cleveland, OH 44110 delinquent taxes $1,855.10

70. 1998 Torbenson DR, Cleveland, OH 44112 delinquent taxes $3,877.43

71. 763 E 152 ST, Cleveland, OH 44110 delinquent taxes $12,565.98

72. 794 E 154 St, Cleveland, OH 44110 delinquent taxes $812.14

73. 341 E 156 St, Cleveland, OH 44110 delinquent taxes $8,262.92

74. 807 E 131 St, Cleveland, OH 44108 delinquent taxes $1,283.44

75. 1373 EAST BLVD CLEVELAND, OH 44106 delinquent taxes $3,993.51

76. 2850 E 127 ST, Cleveland, OH 44120 delinquent taxes $2,200.59

77. 4001 E 151 ST, Cleveland, OH 44120 delinquent taxes $4,794.80

78. 16201 Myrtle AVE, Cleveland, OH 44128 delinquent taxes $4,100.27

79. 3546 Raymont BLVD, University Hts, OH 44118 delinquent taxes $16,666.01

80. 861 Quarry DR, Cleveland Hts, OH 44121 delinquent taxes $18,367.91

81. 22701 Shore Center AVE, Euclid, OH 44123 delinquent taxes $33,336.34

82. 3962 E 41 ST, Newburgh Hts, OH 44105 delinquent taxes $7,703.00

83. 1521 Clarence AVE, Lakewood, OH 44107 delinquent taxes $15,719.32

84. 4328 E 143 ST, Cleveland, OH 44128 delinquent taxes $2,975.68

85. 3769 E 140 ST, Cleveland, OH 44120 delinquent taxes $6,851.10

86. 3279 E 128 ST, Cleveland, OH 44120 delinquent taxes $3,700.37

87. 7915 Sowinski AVE, Cleveland, OH 44103 delinqent taxes $13,719.84

88. 1642 Lockwood CLEVELAND, OH 44112 delinquent taxes $2,799.55

89. 857 E 75 ST, Cleveland, OH 44103 delinquent taxes $735.91

Same issue with all of the property owned ( stolen) by Aeon Financial CapitalSource Bank tax lien thieves. Look at the addresses:

PROPERTY OWNED BY CAPITALSOURCE fbo AEON FINANCIAL

1. 10929 Olivet $11,508.32

2. 1256 E. 125 $ 2,260.85

3. 625 E. 118 $ 2,283.57

4. 950 Ida $ 4,110.78

5. 9314 Yale $ 17,694.10

6. 1074 E. 141 $ 1,456.63

7. 1212 E. 71 $ 3,795.16

8. 1254 E. 102 $ 4,698.89

9. 963 E. 129 $ 5,474.44

10. 1128 E. 141 $ 2,380.34

11. 9809 Parmalee $ 1,825.84

12. 10009 Somerset $ 6,040.64

13. 10001 Somerset $ 5,917.20

14. 377 Eddy Rd. $ 9,204.63

15. 144728 Thames $ 3,431.77

16. 2541 Cedar $ 3,111.53

17. 1603 Holyrood $ 5,894.39

18. 449 E. 147 $ 6,920.61

19. 474 E. 125 $ 5,555.67

20. 10704 Kimberley $ 5,506.13

21. 881 Thornhill $ 6,851.06

22. 573 E. 114 $ 5,002.60

23. 12344 Tuscora $ 2,276.88

24. 12428 Tuscora $ 5,550.28

25. 12424 Saywell $ 7,266.20

26. Lot on Shaw Ave. - parcel # 111-11-043 $ 2,092.65

27. Lot on Shaw Ave- parcel # 111-11-044 $ 1,251.95

28. 12408 Saywell $ 2,444.74

29. 508 E. 114 $ 2,904.62

30. 10117 Flora $ 5,342.50

31. 1204 E. 146 $ 2,692.26

32. 11609 Temblett $ 4,173.79

33. Lot on Lisbon - parcel 126-20-047 $ 6,852.63

34. 6629 Charter $ 2,588.32

35. 2009 Hilton $ 6,129.35

36. 17602 St Clair $ 1,598.30

37. 2175 E. 85 $ 8,419.72

38. 2328 E. 88 $ 2,943.24

39. 10707 Crestwood $ 3,783.64

40. 3457 E. 69 $ 2,198.39

41. 2346 E. 61 $ 1,1154.23

42. 832 E. 154 $ 22,407.06

43. 16437 Braddock $ 3,294.77

44. 1121 Galewood $ 1,775.52

45. 10006 Quebec $ 925.10

46. 3283 E. 103 $ 2,084.64

47. 15609 School $ 3,667.84

48. 2853. E 98 $ 2,858.45

49. 3290 Regent $ 1,560.82

50. 2865 E. 92 $ 940.52

51. 1378 Larchmont $ 4,714.48

52. 1447 E. 162 $ 2,597.65

53. 1443 Lakeview $ 1,561.83

54. 1946 Westburn $ 2,902.79

55. 2185 E. 106 $ ,941.30

56. 5666 Hamlet $ 1,733.07

57. 2620 E. 89 $ 7,118.03

58. 3658 E. 108 $ ,882.61

59. 9416 Manor $ 2,339.26

60. 9516 Hilgert $ 3,185.66

61. 9604 Sophia $ 2,684.87

62. 9323 Mt. Auburn $ 1,081.07

63. 7211 Indiana $ 3,207.47

64. 7203 Indiana $ 1,302.04

65. 4104 E. 79 $ 1,421.11

66. 11804 Dove $ 1, 211.30

67. 15021 Edgewood $ 1,109.90

68. 11726 Parkview $, 2, 308.55

69. 3629 E. 123 $ 11, 413.53

70. 6404 Fullerton $ 165.46

71. 3660 E. 106 $ 769.44

72. 9819 Stoughton $ 2,204.39

73. 3818 E 54 $ 1,036.00

74. 4096 E 57 $ 1,414.37

75. 10002 Stoughton $ 1,113.22

76. 12408 Farringdon $ 248.72

77. 3763 E 126 $ 830.20

78. 3680 E 133 $ 762.04

79. 3933 E 66 $ 3,765.48

80. 6826 Krakow $ 2,416.55

81. 2814 E 127 $ 3,268.41

82. 6622 Fullerton $ 7,005.50

83. 13002 Benham $ 186.74

84. 3753 E. 93 $ 4,500.35

85. 3239 E 117 $ 1,540.88

86. 3828 E 140 $ 1,376.94

87. 4129 E 110 $ 2,701.08

88. 3669 E 52 $ 701.84

89. 10902 Gay $ 1,474.08

90. 3461 E 143 $ 1,290.16

91. 7803 Connecitut $ 1071.26

92. 4267 E 114 $ ,149.92

93. 3675 E 139 $ 835.70

94. 2993 E 128 $ 964.00

95. 8607 Grand Division $ 2,303.04

96. 3672 E 54 $ 2,530.69

97. 16401 Judson $ 1,419.76

98. 17214 Lotus $ 2,946.38

99. 3943 Strandhill $ 1,632.94

100. 4811 E 176 $ 1,516.94

101. 4266 E 160 $ 2,932.00

102. 3104 Russell $ 1,632.17

103. 4991 E. 90 $ 3,352.45

104. 325 E 215 $ 2,207.06

105. 1444 Sulzer $ 4,975.69

106. 19071 Pasnow $ 1,579.27

107. 851 Nelaview $ 17,564.49

108. 2268 Taylor $ 10,603.20

109. 1300 E 143 $ 3,507.89

110. 1346 E 141 $ 2,601.49

111. 1466 E 134 $ 3,242.01

112. 14212 Savannah $ 2,101.17

113. 13313 Gainsboro $ 3,258.37

114. 1176 Bender $ 2,360.17

115. 3197 East Berkshire $ 2,688.04

116. 15345 Plymouth $ 2,970.46

117. 3254 East Berkshire $ 6,860.73

118. 1520 E. 133 $ 1,953.65

119. 1536 Lakefront $ 1,222.80

120. 13818 Woodworth $ 3,068.77

121. 1732 Shaw $ 3,020.61

122. 13701 Graham $ 1,929.68

123. 1355 Dill $ 14,440.65

124. 3709 Sudberry $ 2,164.62

125. 19300 Fairway $ 3,559.62

126. 18975 Van Aken $ 2,333.93

127. 15675 Friend $ 3,169.92

128. 5144 Theodore $ 5,339.30

129. 5178 Theodore $ 12,798.08

130. 20715 East Ridgewood $ 2,215.08

131. 22741 Libby $ 2,117.84

132. 15316 Northwood $ 4,906.42

133. 19707 Kings Highway $ 7.082.82

134. 17109 Mapleboro $ 2,441.02

135. 21504 Franklin Rd. $ 3,462.24

136. 19302 Shakerwood $ 3,675.84

137. 23823 Banbury $ 2,108.58

138. 19611 Longbrook $ 1,529.60

139. 4490 Granada $ 4,792.20

140. 3643 Rolliston $ 13,984.08

141. 21009 Hillgrove $ 12,218.75

142. 00023 Whitaker $ 3,282.36

143. 8010 Bellevue $ 1,623.28

144. 2346 E 61 $ 1,1162.47

145. 3772 E 144 $ 1,391.60

146. 4230 E 98 $ 4,395.75

147. 3741 E 143 $ 2,690.60

148. 4155 E 141 $ 974.68

149. 4161 E 189 $ 1,073.68

150. 4185 Lee $ 2,773.88

151. 4658 E 157 $ 1,179.61

152. 17116 Judson $ 1,171.10

153. 4839 E 86 $ 11,650.61

154. 12813 North Parkway $ 4,751.08

155. 4949 E 141 $ 5,234.68

156. 11215 Plymouth $ 3,557.42

157. 13118 Forestdale $ 6,595.92

158. 4705 E 93 $ 2,554.40

159. 12809 Rexwood $ 5,092.39

160. 20271 Priday $ 1,571.94

161. 316 E 260 $ 5,385.39

162. 1507 E 256 $ 1,932.77

163. 20060 Champ $ 5,237.92

164. 1464 E 250 $ 3,349.99

165. 1277 Hayden $ 4,841.88

166. 1245 Rozelle $ 2,272.17

167. 14631 Savannah $ 3,258.21

168. 14317 Terrace $ 4,685.80

169. 13915 Scioto $ 3,071.37

170. 12824 Speedway Overlook $ 3,088.80

171. 1627 Eddy $ 1,682.69

172. 14004 Ardenall $ 2,135.39

173. 13909 Potomac $ 1,997.28

174. 1888 Wymore $ 2,561.83

175. 14208 Potomoc $ 2,681.33

176. 1730 Allandale $ 2,243.45

177. 1768 Coit $ 1,048.05

178. 1780 Delmont $ 33,482.90

179. 19505 Kings Highway $ 1,812.64

180. 10510 Madison $ 1,606.24

181. 5916-18 Madison $ 16,159.99

182. 6004 Madison $ 5,573.04

183. 2128 W 105 $ 3,441.42

184. 6808 Lorain $ 1,692.04

185. 3082 W 110 $ 4,475.88

186. 2092 W 87 $ 4,032.15

187. 2061 W 95 $ 3,180.26

188. 7315 Lawn $ 853.96

189. 3628 Hyde $ 4,980.90

190. 3431 W 62 $ 820.16

191. 3062 Sackett $ 3,211.07

192. 3721 W 39 $ 1,019.44

193. 7503 Dearborn $ 4,015.15

194. 3541 Trowbridge $ 556.36

195. 3115 W 88 $ 1,444.70

196. 3219 W 88 $ 3,133.68

197. 3807 Robert $ 1,409.30

198. 3122 W 52 $ 1,079.36

199. 3403 W 58 $ 3,045.71

200. 3159 W 94 $ 968.52

201. 3189 W 86 $ 3,078.57

202. 4510 Bush $ 3,635.48

203. 3413 W 90 $ 1,650.76

204. 3432 W 91 $ 1,126.80

205. 12809 Guardian $ 6,331.86

206. 4068 E 57 $ 2,671.43

207. 13015 Lorenzo $ 1,126.80

208. 16417 Westview $ 3,208.42

209. 1524 E 195 $ 1,311.00

210. 1028 E 169 $ 5,024.21

211. 21019 Kenyon $ 2,016.60

212. 2069 W 83 $ 2,445.45

213. 3847 w 136 $2,143.08

214. 19610 Meadowlark $ 2,073.58

215. 4416 Parkton $ 6,592.70

216. 23412 Kirkland $ 1,381.94

217. 4510 Storer $ 2,362.13

218. 3639 Randolph $ 9,636.44

219. 1028 E 169 $ 5,204.21

220. 21019 Kenyon $ 2,016.60

221. 7207 Duluth $3,285.61

222. 1200 E. 61 $ 1,143.68

223. 3339 W. 94 $ 3,230.17

224. 2128 W. 105 $ 3,441.42

225. 10329 Yale $ 4,288.48

226. 902 Herrick $ 2,297.13

227. 1242 E. 100 $ 1,877.17

228. 10835 Hampden $ 556.36

229. 11209 Whitmore $ 3,925.70

230. 869 E. 140 $ 6,665.49

231. 1357 E. 170 $1,178.30

232. 5611 Outhwaite $ 1,226.24

233. 2865 E. 92 $ 940.52

234. 4068 E. 57 $ 2,671.43

235. 3675 E 139 $ 835.70

236. 19071 Pasnow $ 1,599.27

237. 1464 E 250 $ 3,349.99

238. 952 Wheelock $ 3,128.84

239. 661 E. 94 $ 1,634.66

240. 10009 Ostend $ 1,008.46

241. 13904 Darley $ 837.06

242. 11418 Notre Dame $ 2,000.56

243. 8614 Capital $ 1,742.84

County officials finally woke up and on November 6, 2012, filed a delinquent property tax foreclosure case againt the property owner - Sam Nazmi Khaleq.

CV-12-795120 TREASURER OF CUYAHOGA COUNTY, OHIO vs. NAZMI KHALEQ AKA SAM KHALEQ - ET AL.

Sam Nazmi Khaleq's solution to the county's wake up call is pulling the Gus Frangos con job and tranferring the property into a LLC: http://realneo.us/content/gus-frangos-president-cuyahoga-county-land-bank-and-his-shell-llc-properties-new-photos

In March 2013, in an obvious move to save the property from tax foreclosure, Sam Nazmi Khaleq transferred the property to a self-incorporated LLC:

The LLC was incorporated by Sam Nazmi Khaleq:

Why was this property overlooked for years and have the ability to owe over $40,000 in delinquent property taxes???

On November 13 1995, Sam Nazmi Khaleq transferred the property located at 2700 Carroll Avenue in Cleveland, Ohio to Ohio City Development.

Dave's Supermarket is located at 2700 Carroll Avenue.

Dave's Markets - Cleveland, OH Dave's Grocery Stores - 2700 Carroll Avenue, Cleveland, 44113 ...

*** My blogs expressing my freedom of speech rights - especially on matters of public concern - are my opinion and not the opinion of my friends, family or employer ***

( categories: )

|

Recent commentsPopular contentToday's:

All time:Last viewed:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trying to eliminate public access to meetings & records

Those responsible for making incompetent decisions - such as the above - are attempting to eliminate the public's right to records and attend meetings.

This story specifically mentions the county treasurer, fiscal officer, auditor and economic development.

Four positions that have been abused repeatedly here in Cuyahoga County and they want to cut off our access to our PUBLIC records.

They want to keep their misconduct hidden:

http://www.cleveland.com/open/index.ssf/2013/06/changes_pending_in_the_general.html#incart_river_default#incart_2box

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Trouble making CRIMINALS on Brayton get a free property tax ride

Trouble making criminals residing at 757 Brayton Avenue get a free property tax ride also:

2002 (pay in 2003)

2003 (pay in 2004)

2004 (pay in 2005)

2005 (pay in 2006)

2006 (pay in 2007)

2007 (pay in 2008)

2008 (pay in 2009)

2009 (pay in 2010)

2010 (pay in 2011)

2011 (pay in 2012)

2012 (pay in 2013)

NO property taxes paid in YEARS. Taxes owed $ 3,735.83

NEVER sold out to tax lien thieves. No property tax foreclosures filed by the county.

According to Fiscal Office records, this trouble making property is owned by deceased Charles Wolf.

However according to a recorded document search, the property is allegedly owned by 763 Brayton Property LLC, although according to county records NO documents were ever filed transferring the property from the deceased Charles Wolf to John Gillota or 763 Brayton LLC:

Recorded Date

Last Name

Document Number

Document Type

*The county made a mistake by putting parcel # 004-22-058 recorded documents in with recorded documents for parcel # 004-22-056*

And the county made a mistake by not enforcing property tax collection fairly by overlooking the Brayton Avenue property taxes for years.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Clarification on Brayton property

To clarify what I wrote.

Recorded Date

Last Name

Document Number

Document Type

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Delinquent property tax foreclosure for $184.50

One of the few times the 'state-of-the-art' tax process worked was when the county treasurer filed a delinquent property tax foreclosure on Frank Giglio's property.

Frank Giglio owed a grand sum of $184.50 - less than 200 dollars.

BR-09-002401

Delinquent Property Taxes overlooked for YEARS

Transfer Date 9/30/09. No taxes paid since the transfer. Taxes owed $ 5,989.25

Detroit Shoreway Realty Partners LLC is not registered with the State of Ohio

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

URBAN INVESTMENTS GROUP INC.

LAVELLE GREEN

This LLC has been playing real estate games for many years. Numerous properties and no property taxes paid for years and they owe the county well over $100,000 in property taxes.

They are working with EconoHomes LLC and the county's land bank is in the process of taking numerous properties that have been overlooked for taxes for many years.

EconoHomes LLC is located in Texas:

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

OSHUN DEVELOPMENT GROUP LLC

20133 FARNSLEIGH RD

SHAKER HEIGHTS,OH 44122

Effective Date: 02/04/2009

Contact Status: Active

JESSICA O TRAN

No property taxes paid in years. Delinquent property taxes overlooked for years 33,745.40 & 2,731.70

________________________________________________________________________________________________________________________________________________________________________

1158 East 61st LLC, aka Gus Frangos' shell LLC property. Delinquent property taxes overlooked for years.

5815 BONNA AVENUE

CLEVELAND,OH 44103

Effective Date: 06/30/2011

Contact Status: Active

7323 CLINTON RD

BROOKLYN,OH 44144

Effective Date: 02/09/2004

Contact Status: Active

TWENTIETH FLOOR 1300 EAST NINTH STREET

CLEVELAND,OH 44114

Effective Date: 04/16/2010

Contact Status: Active

1725 WYMORE AVENUE

EAST CLEVELAND,OH 44112

Effective Date: 07/22/2005

Contact Status: Active

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Sam Khaleq = Cummins land deal??

Remember the great historic tax switch Brian Cummins' wanted to play with the firehouse on West 25th ?

Well - one stumbling block was the tax delinquency of Sam Khaleq - his property at 3025 West 25th - had over 50,000 + in unpaid taxes. Mr. Khaleq, who lives in Medina County - created the 3025 LLC - which is still not showing up at State of OH Business filings.

He "apparently" paid off the tax delinquency - or did he? His slum property in Clark-West 25th area is going to be featured by Joe Pagonakis as an example of graffiti tagging in Cleveland.